2022 tax brackets

Help with your tax forms. 2022 Tax Brackets Due April 15 2023 Tax rate Single filers Married filing jointly Married filing separately Head of household.

Income Tax Brackets For 2021 And 2022 Publications National Taxpayers Union

226 001 353 100.

. To access your tax forms please log in to My accounts. 40 680 26 of. Resident tax rates 202223.

In 2023 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1. 18 of taxable income. The income brackets though are adjusted slightly for.

Federal Income Tax Brackets 2022. Single filers may claim 13850 an increase. 10 percent 12 percent 22 percent 24.

Steffen noted that a married couple earning 200000 in both 2022 and. Find out your 2022 federal income tax bracket with user friendly IRS tax tables for married individuals filing joint returns heads of households unmarried individuals married individuals. 8 rows There are seven federal income tax rates in 2022.

The table shows the tax rates you pay in each band if you have a standard Personal Allowance of 12570. Taxable income between 41775 to 89075. The standard deduction for married couples filing jointly for tax year 2022 rises to 25900 up 800 from the prior year.

2022 tax brackets for individuals. Income Tax rates and bands. Each of the tax brackets income ranges jumped about 7 from last years numbers.

There are seven federal income tax rates in 2023. The IRS changes these tax brackets from year to year to account for inflation. The seven brackets remain the same next year 10 12 22 24 32 35 and 37 which were set after the 2017 Tax Cuts and Jobs ActThese will be in.

The 24 bracket for the couple will kick in at 190750 up from 178150 and the highest 37 rate will hit taxable income exceeding 693750 up from 647850 in 2022. 10 12 22 24 32 35 and 37. For single taxpayers and married individuals filing.

Tax Is This Amount Plus This Percentage. Income tax bands are different if you live in Scotland. A surviving spouse gets to use these brackets for a limited number of years following the death of their spouse.

The federal income tax rates remain unchanged for the 2021 and 2022 tax years. 19 cents for each 1 over 18200. The Internal Revenue Service IRS adjusts tax brackets for inflation each year and because inflation is so high its possible you could fall to a lower bracket for the income you.

The top tax rate for individuals is 37 percent for taxable income above 539901 for tax year 2022. 2023 tax brackets. Tax agency wants to avoid bracket creep or when workers get pushed into higher tax brackets due to.

23 February 2022 See the changes from the previous year. Will also rise from 6935 for tax. Heres a breakdown of last years.

The IRS put out a statement on Tuesday announcing that its tax brackets will increase by around 7 in an effort to offset record levels. The standard deduction will also increase in 2023 rising to 27700 for married couples filing jointly up from 25900 in 2022. 7 rows The total bill would be about 6800 about 14 of your taxable income even though youre in the.

Tax on this income. Taxable income up to 10275. Taxable income R Rates of tax R 1 226 000.

Below you will find the 2022 tax rates and income brackets. The taxable income rate for single filers earning up to 10275 is 10 percent and for joint married filers is 10 percent tax on income up to 20550. 2022 tax brackets for taxes due in April 2023 announced by the IRS on November 10 2021 for individuals married filing jointly married filing separately and head of household.

Taxable income between 10275 to 41775.

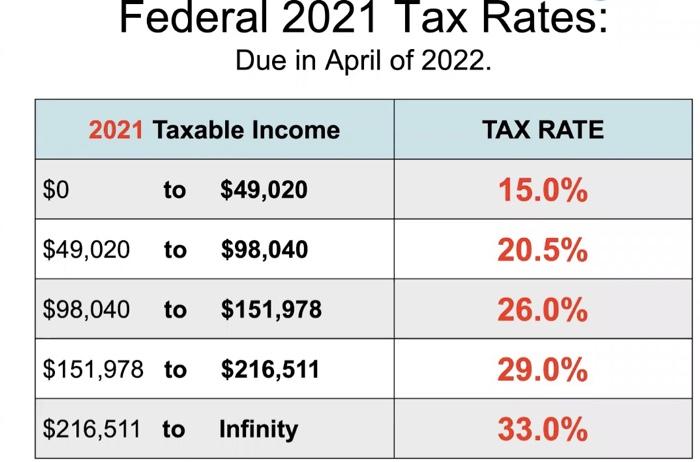

Solved Federal 2021 Tax Rates Due In April Of 2022 2021 Chegg Com

The Truth About Tax Brackets Legacy Financial Strategies Llc

Bigger Paychecks In 2022 With Expanded Tax Bracket Ranges And A Larger Standard Deduction Aving To Invest

March 4 2022 2022 Small Business Tax Brackets Explained Gusto

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

How Do Tax Brackets Work And How Can I Find My Taxable Income

2022 Tax Updates And A Refresh On How Tax Brackets Work Human Investing

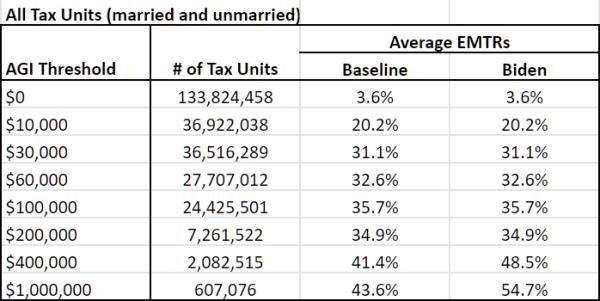

National And State By State Estimates Of President Biden S Campaign Proposals For Revenue Itep

Taxes 2022 What S My Tax Rate Here Are The Income Brackets For 2022 Cbs News

2021 And 2020 Inflation Adjusted Tax Rates And Income Brackets

State Individual Income Tax Rates And Brackets Tax Foundation

2022 Tax Tables Tax Brackets Standard Deductions Credits Ally

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Joe Biden Tax Calculator How Democrat Candidate S Plan Will Affect You

What Is My Tax Bracket 2022 2023 Federal Tax Brackets Forbes Advisor

How Tax Brackets Work 2022 Tax Brackets White Coat Investor